Financial Information

This webpage provides financial updates on the CIWA program. Unless otherwise noted, the financial information including exchange rates reflects the status as of June 30, 2023.

The CIWA program is supported by a Multi-Donor Trust Fund (MDTF) and administered by the World Bank on behalf of contributing development partners. CIWA’s ongoing donors are Denmark, the European Commission, the Netherlands, Norway, Sweden, and the United Kingdom. This MDTF is known as a “Programmatic Multi-Donor Trust Fund, ” in which donors commit funds to support a thematic framework rather than a specific project. Within this framework, CIWA supports projects executed by recipient organizations and those directly executed by the World Bank.

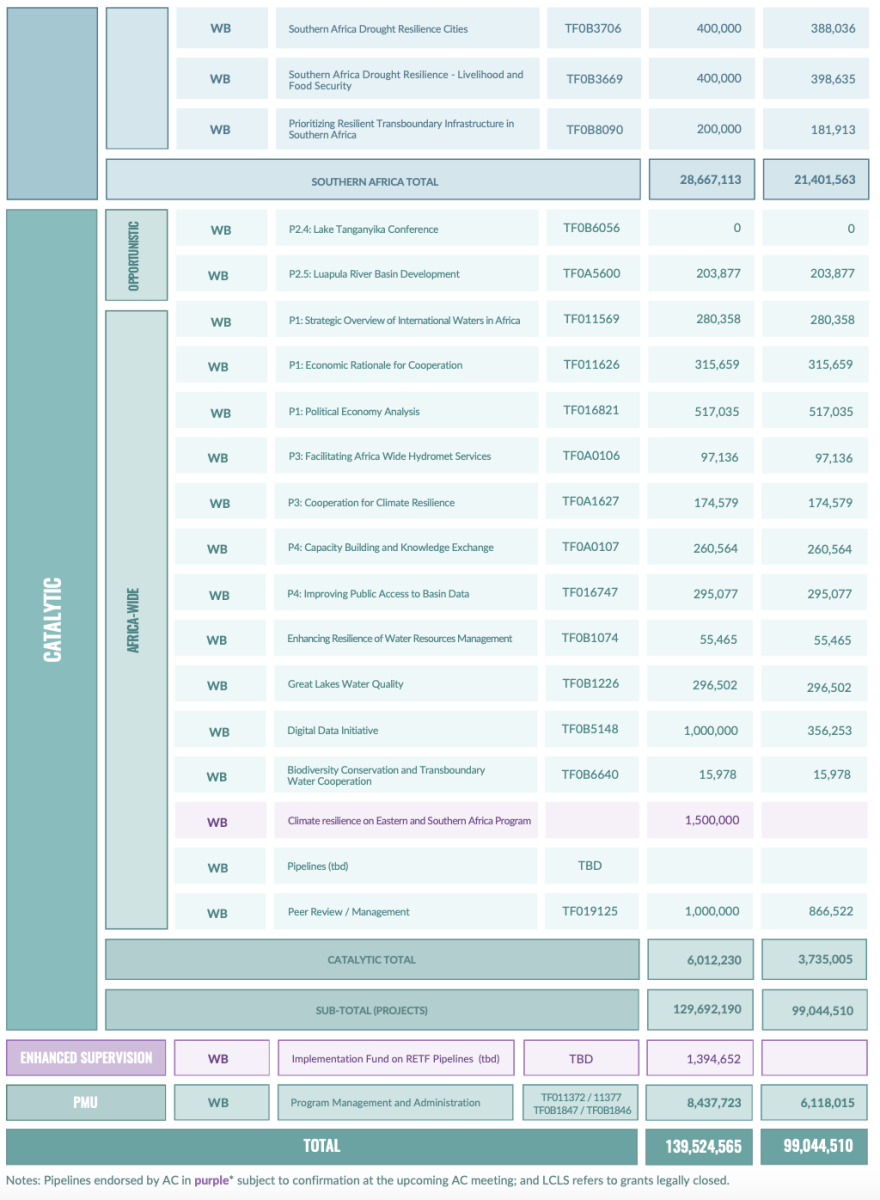

Funding Process and Disbursement

Consistent with standard World Bank Trust Fund practices, donors pledge funding for CIWA (total pledge was US$140.6 million) and funds are deposited on an agreed schedule (deposits totaled US$131.1 million). Under CIWA’s strategic planning efforts, funding has been allocated to specific programs and projects (current allocations are at US$139.5 million) around the broad themes and areas endorsed by the CIWA Advisory Committee (AC).

Additional details on pledges, deposits, allocations, commitments, and disbursements are presented in Annex 4 of the Annual Report 2023.

After the funds are allocated to specific activities, CIWA works with clients to develop Grant Funding Requests to transfer funds into activity accounts. The World Bank follows technical, legal, and fiduciary procedures to approve projects and commits funds through its standard fiduciary processes (commitments totaled US$131.5 million). Funds were disbursed according to the grant agreements and financing plans (disbursements reached US$99 million). Figure A4.1 presents the overall status.

Most of CIWA funds (98 percent) are allocated to existing projects and technical assistance. Any significant future activities will depend strictly upon the availability of new donor contributions.

Donor Pledges, Deposits, and Allocations

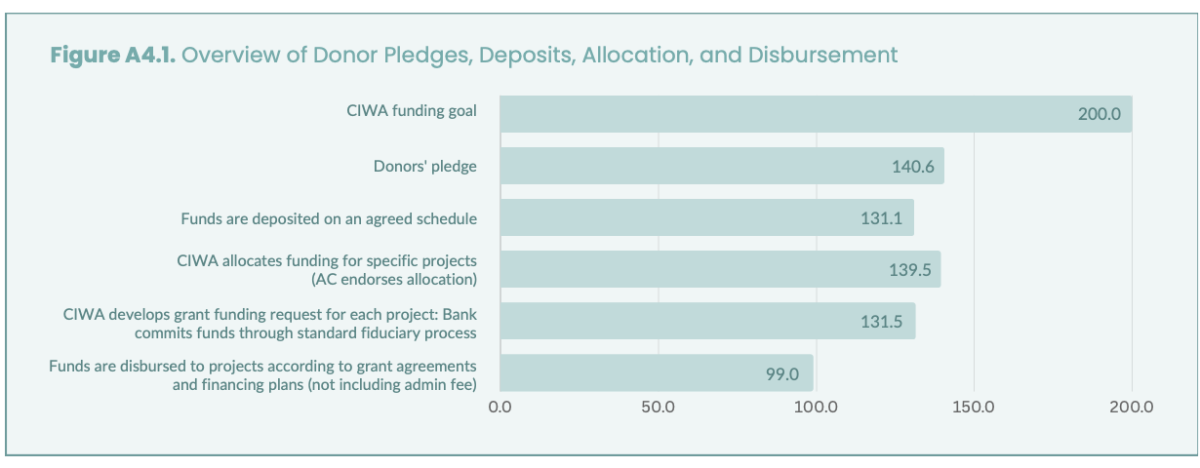

Donors deposit funds in the CIWA MDTF account according to an agreed schedule of deposits that are detailed in the Administration Agreement or other documents exchanged between the Bank and donors. This schedule may be revised if necessary to meet project disbursement requirements. Table A4.1 provides the status of donor pledges and deposits.

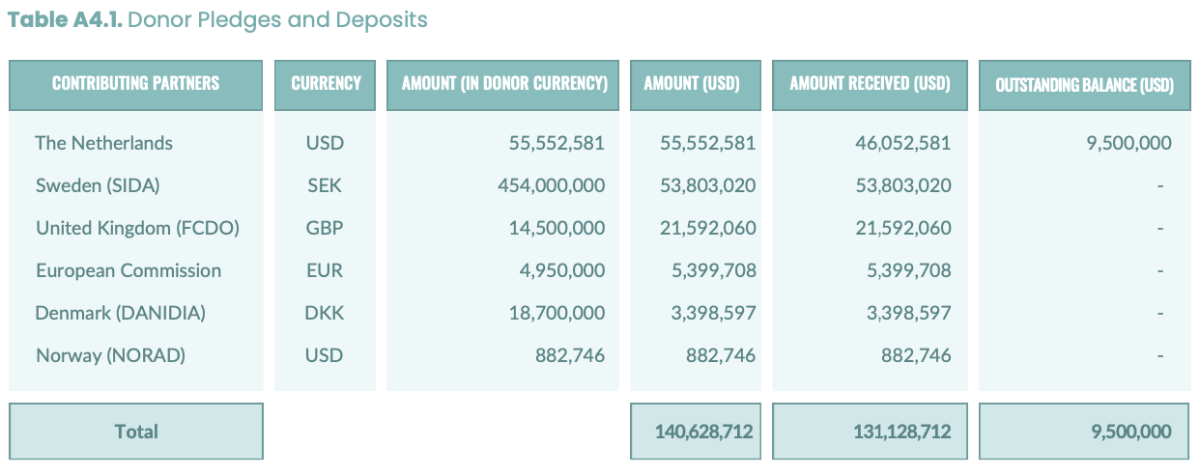

As of June 30, 2023, US$139.5 million has been indicatively allocated to CIWA projects and activities. These allocations included actual grants and pipeline allocations endorsed by the CIWA Advisory Committee as of June 30, 2023, which may be subject to further changes after July 1, 2023.

Most CIWA funding has been assigned to activities under preparation or implementation. Unallocated funds amount to US$2.4 million, and current demand for support far exceeds current resources. Given the centrality of shared waters to Africa’s economic, social and environmental progress, we anticipate that this demand will continue to grow (see Table A4.2).

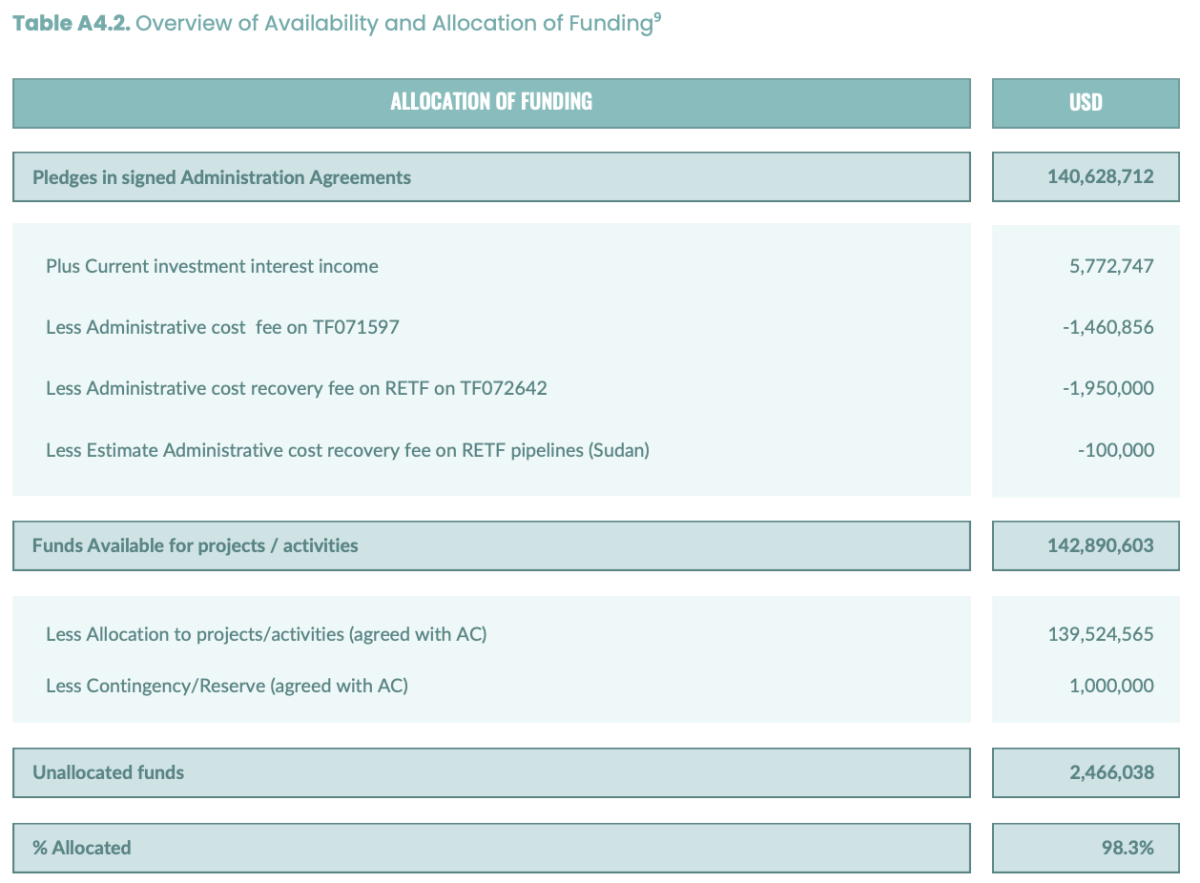

Of the US$139.5 million indicative allocation, 93.9 percent (US$131 million) is allocated to CIWA’s sub-programs including the Horn of Africa, Nile Basin, West and Central Africa, Southern Africa, and Africa-wide analytical work.

CIWA includes recipient-executed projects and Bank-executed support programs that fund technical assistance and analytical work complementing the RETF projects. In some instances, CIWA has allocated funding for follow-up effort on current projects, based on project and organizational performance and riparian states’ commitment.

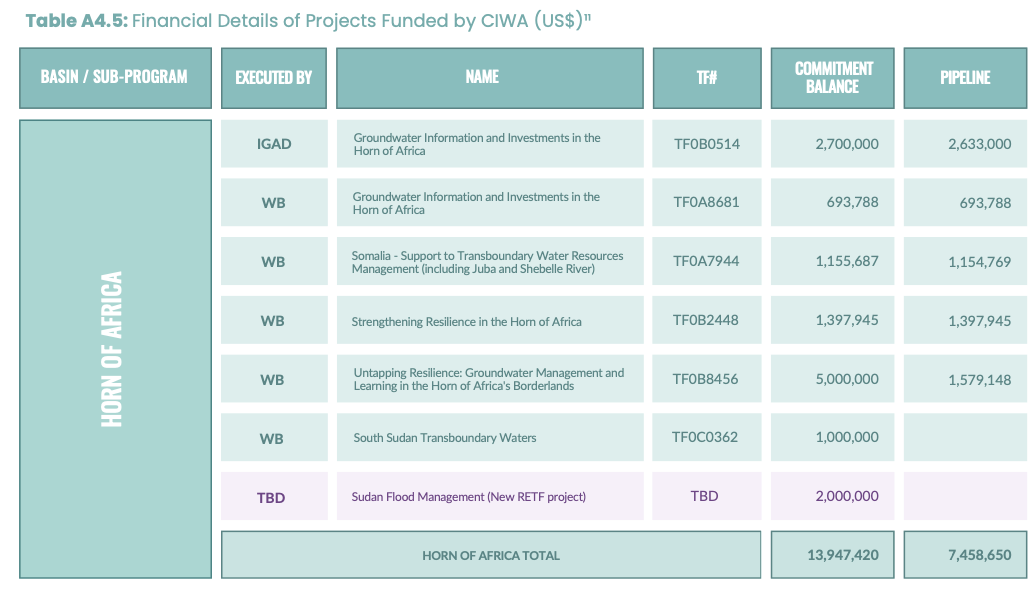

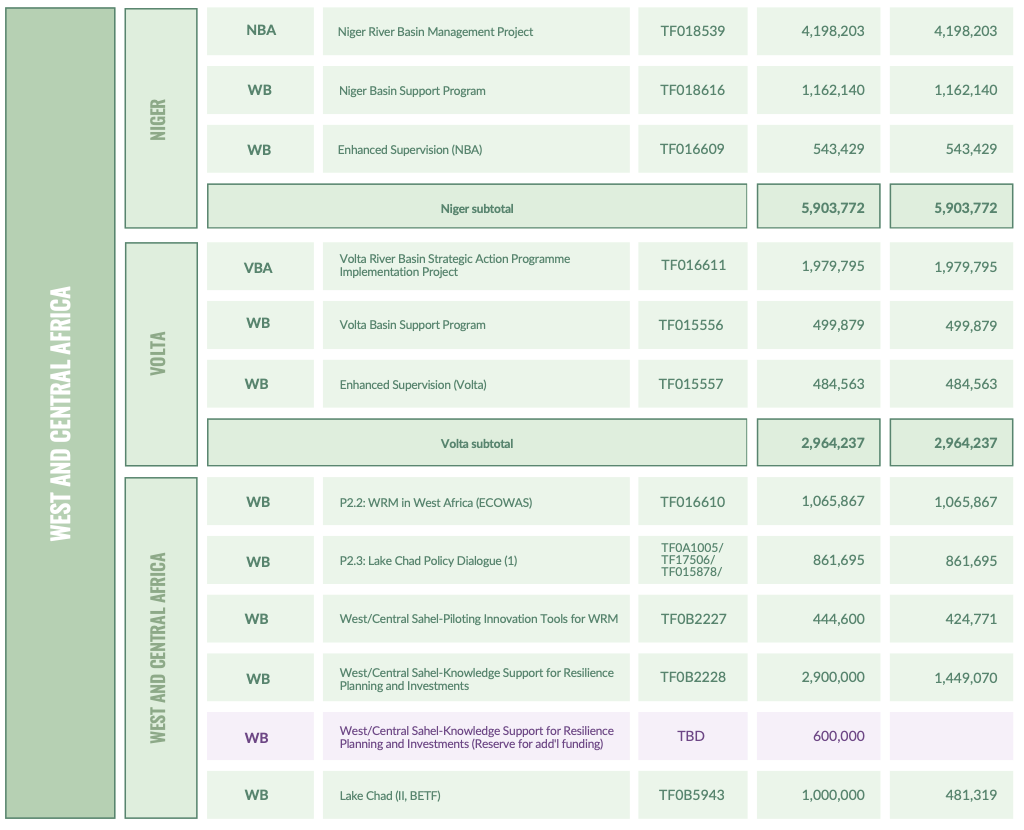

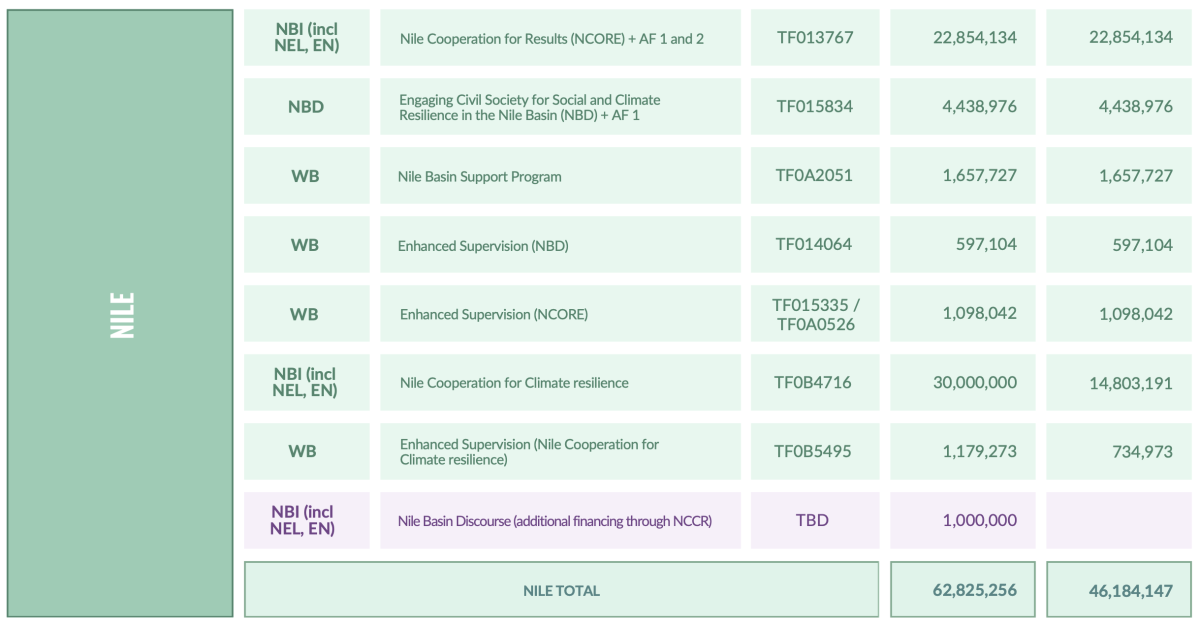

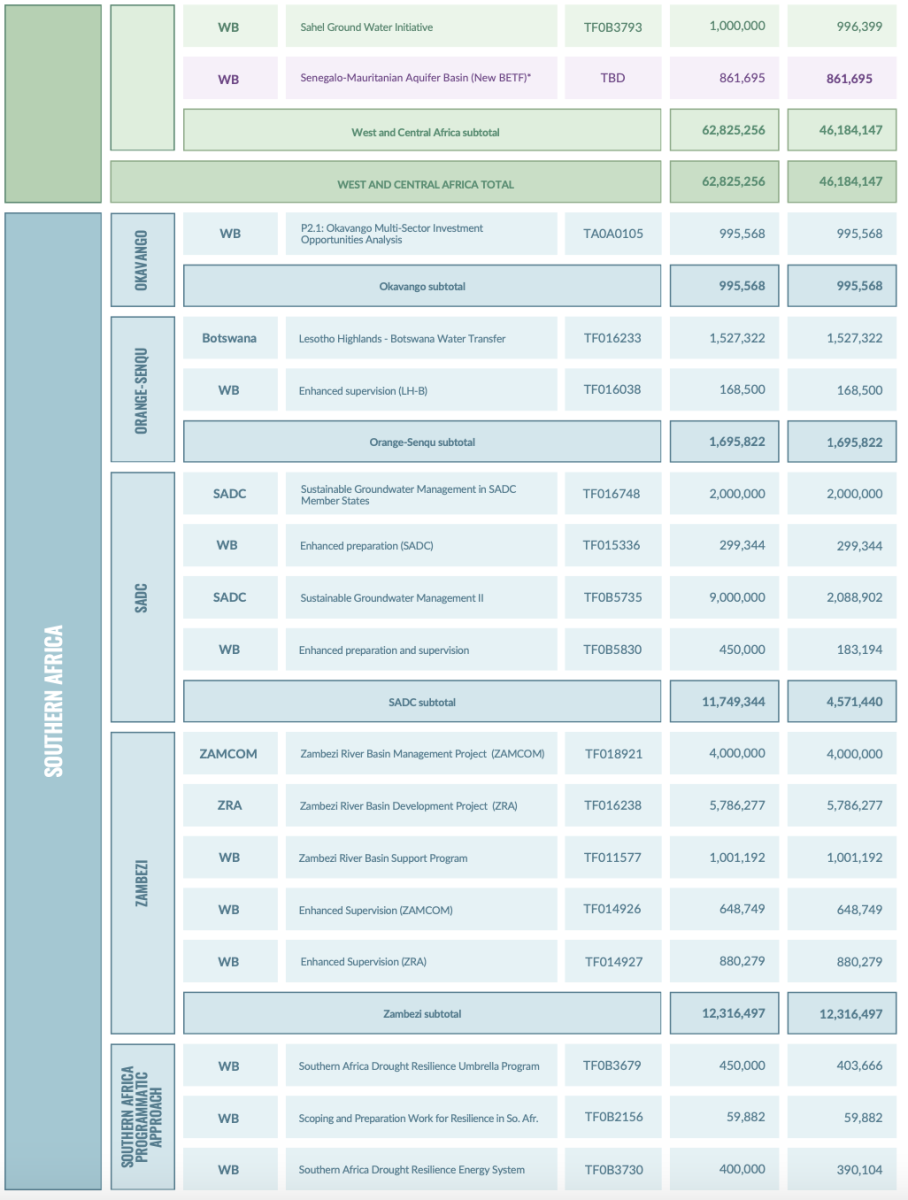

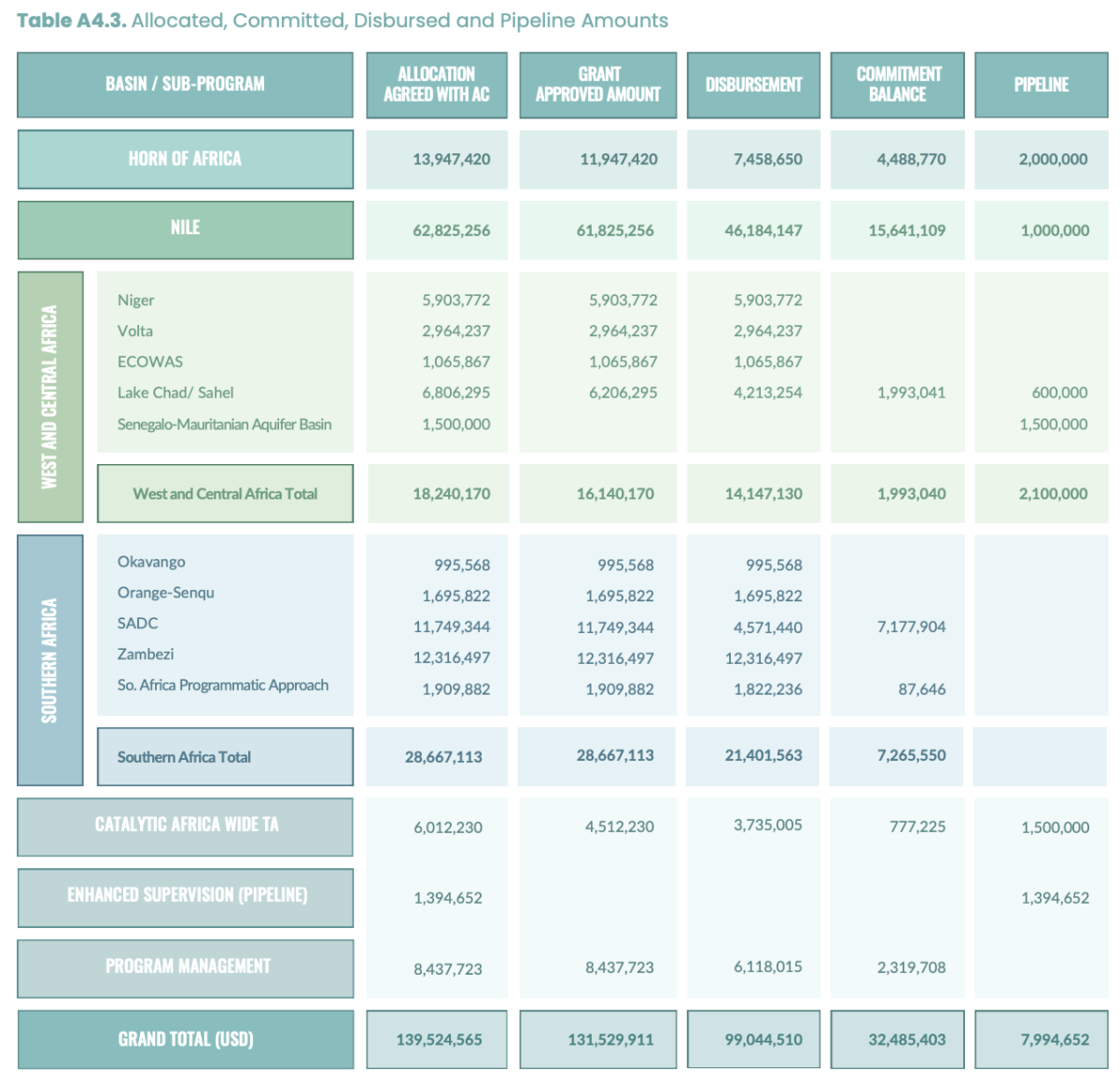

By the end of FY23 the program had committed a cumulative US$131.5 million in grants, of which projects and activities disbursed US$99 million (75 percent). Table A4.3 provides a financial overview by sub-program and Table A4.5 provides details of all CIWA projects and their financial results for which grants have been established since the inception of the program.

Income, Disbursement, and Funding Balance

By the end of FY23, CIWA received US$136.9 million, including US$131.1 million in donor payments and US$5.7 million in investment income from the CIWA account.

Cumulative disbursements are at US$102.4 million, including US$99 million in projects and US$3.4 million in administrative fees. The pace of disbursement accelerated in FY23. The balance of grant commitments is at US$32.5 million. Table A4.4 presents the balance available in the CIWA account, which is approximately US$34.5 million, or a balance of negative US$6.1 million when the balance of current commitments of US$40.5 million is considered.

⁹ ‘Allocation’ refers to the endorsement of allocation of funds by the CIWA AC—both moved to actual grants and notional allocations yet to move to grant activity accounts. ‘Commitment’ refers to recognition by internal World Bank systems that funds have been assigned to a project or activity. Funds are committed when a GFR has been approved by the World Bank trust fund management, putting in place a contractual or scheduled commitment that leads to actual expenditures in the future.‘Disbursement’ refers to the transfer of funds from the grant account to the client’s designated account after a request for specific investments is cleared by the Bank. For Bank-executed grants, disbursements are payments made against a purchase order or contract.

‘Pipeline’ activities in the sub-program are those for which a conditional allocation endorsement was made or subject to the approval of the World Bank project and trust fund systems. Pipeline development is on-going, subject to change including notional allocations after June 30, 2023.

Financial Summary of Program Management

CIWA management costs include expenses incurred by the Program Management Unit (PMU) and the World Bank’s technical experts who provide strategic advice and support. In addition to staff and consultant costs, this category includes costs associated with CIWA donor coordination, outreach, and communications, monitoring and evaluation, mid-term review, reporting, partnership meetings, and dissemination activities including website, brochure, and publications.

Since the program began in 2011, CIWA has spent approximately 4.5 percent on program management, keeping PMU expenses within the suggested range. Overall, the program has been cost-efficient in its management, benefiting from the robust financial management and monitoring systems established at program inception.

Future Funding Requirements and Resource Mobilization

CIWA regularly examines its existing portfolio and plans pipelines to achieve results across Africa. Lessons learned from implementation are integrated into planning of future engagements, alongside application of risk management tools in the context of CIWA finance, detailed in Annex 3 of the Annual Report 2023.

Demand for the CIWA program has exceeded the program’s current resources. At present, CIWA has allocated 98 percent of its available funding. In response to the substantial demand from its clients and to expand its impact, the program has identified a pipeline of potential projects that will exceed current resources. CIWA is therefore working actively to explore opportunities for additional sources of funding.